japan corporate tax rate kpmg

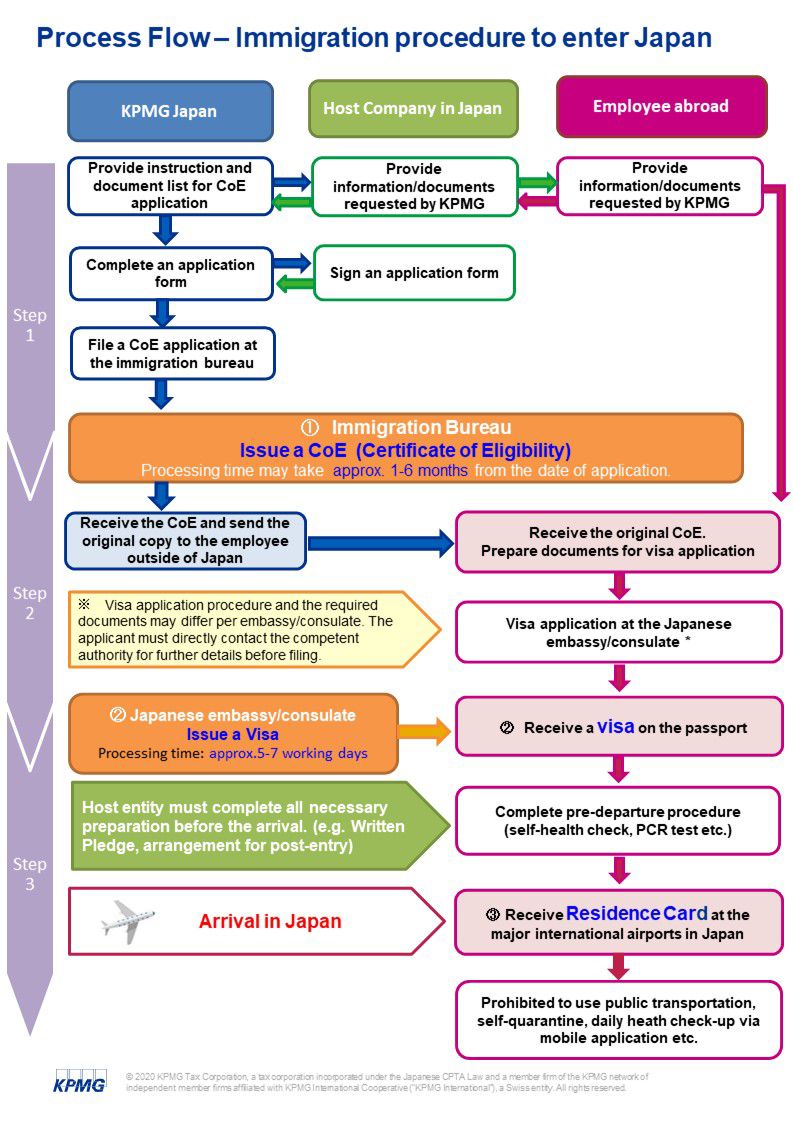

Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their. Taxation in Japan 2021.

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

Corporation tax is payable at 255.

. Local corporation tax applies at 44 on the corporation. This booklet is intended to provide a general overview of the taxation system in Japan. Tax Rate Applicable to fiscal years Corporation tax is payable at 2 beginning between 1 April 2016 and 31 March 2017 Tax rates for companies with stated capital of JPY 100 million or.

Corporate tax rates table. The contents reflect the information available up to 31 Octobe Taxation in Japan 2019 -. Use our interactive Tax rates tool to compare tax rates by country or region.

Employer companies are required to treat the contribution payments as donations for corporate income tax purposes. The effective corporate tax rate using Tokyo tax rates applied to a company whose stated capital is over JPY100 million is currently 3564 percent. Short-term gains are taxed at a flat rate of 3063.

KPMG Tax Corporation provides a coordinated approach to tax services that combines among the best of our local skills knowledge and experience with the resources of KPMG. KPMGs corporate tax table provides a view of corporate tax rates around the world. Regular business tax rates currently apply and vary between 16 percent and 372 percent depending on the tax base taxable income and the location of the taxpayer.

The corporation tax is imposed on taxable income of a company at the following tax rates. The maximum rate of 147 percent is levied in Tokyo metropolitan. National local corporate tax Beginning from 1 October.

Use our interactive Tax rates tool to compare tax rates by country or region. Corporation tax is payable at 234. KPMGs corporate tax table provides a view of corporate tax rates around the world.

6 The special local tax is 81 percent of the prefectural enterprise tax for. KPMG in Japan was established when KPMG opened a network office in 1954. Japan corporate tax rate kpmg.

Long-term gains are taxed at a flat rate of 15315 percent including surtax of national income tax plus 5 percent of local inhabitant tax. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended that specific advice be taken as to the tax implications of any proposed or actual transactions. Use our interactive Tax rates tool to compare tax rates by country or region.

National local corporate tax. Before 1 October 2019 the national local corporate tax rate was 44. Tax base Small and medium- sized companies 1 Other than small and medium-sized companies.

KPMG Tax Corporations strength is its ability to offer services for a broad range of clients tax needs. 5 Standard rate 123 percent of the central tax. KPMGs corporate tax table provides a view of corporate tax rates around the world.

Tax rates for companies with stated capital of more than JPY 100 million are as follows. Tax Rate Applicable to fiscal years beginning before 1 April 2015 Tax rates for companies with stated capital of JPY 100 million or greater are as follows. Standard enterprise tax and local corporate special tax.

While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended. Taxation in Japan 2020. Tax revenue stood at 48 GDP in 2012.

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Japan S Kan Seeks Corporate Tax Cut Wsj

Japan Taxation Of International Executives Kpmg Global

Corporate Inversions The End Again Stout

World S Highest Effective Personal Tax Rates

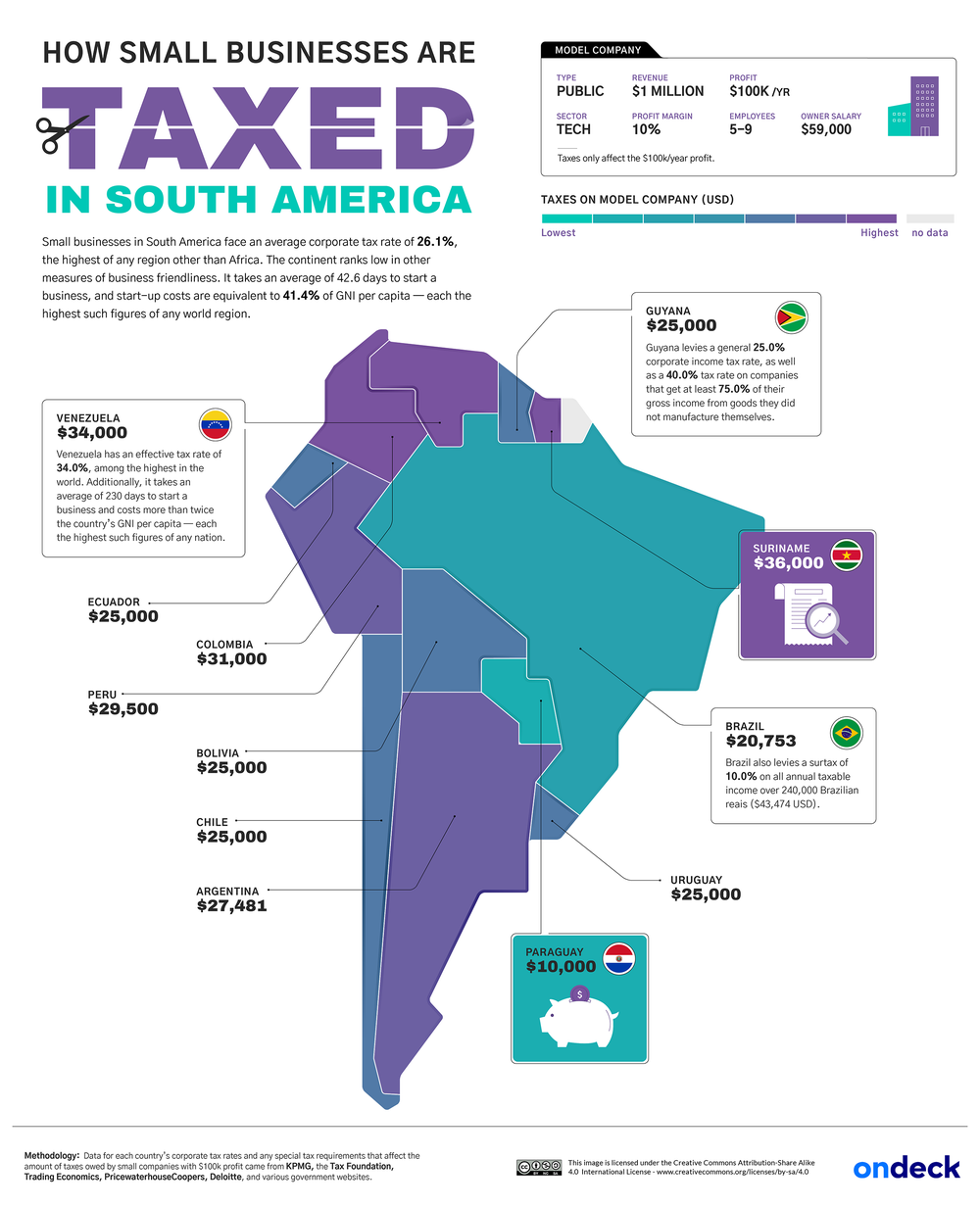

Taxes On Small Businesses Across The Globe Mapped See Where Rates Are High Low And Nonexistent

Kpmg Fined 3 4m Over Serious Failures In Rolls Royce Audit Kpmg The Guardian

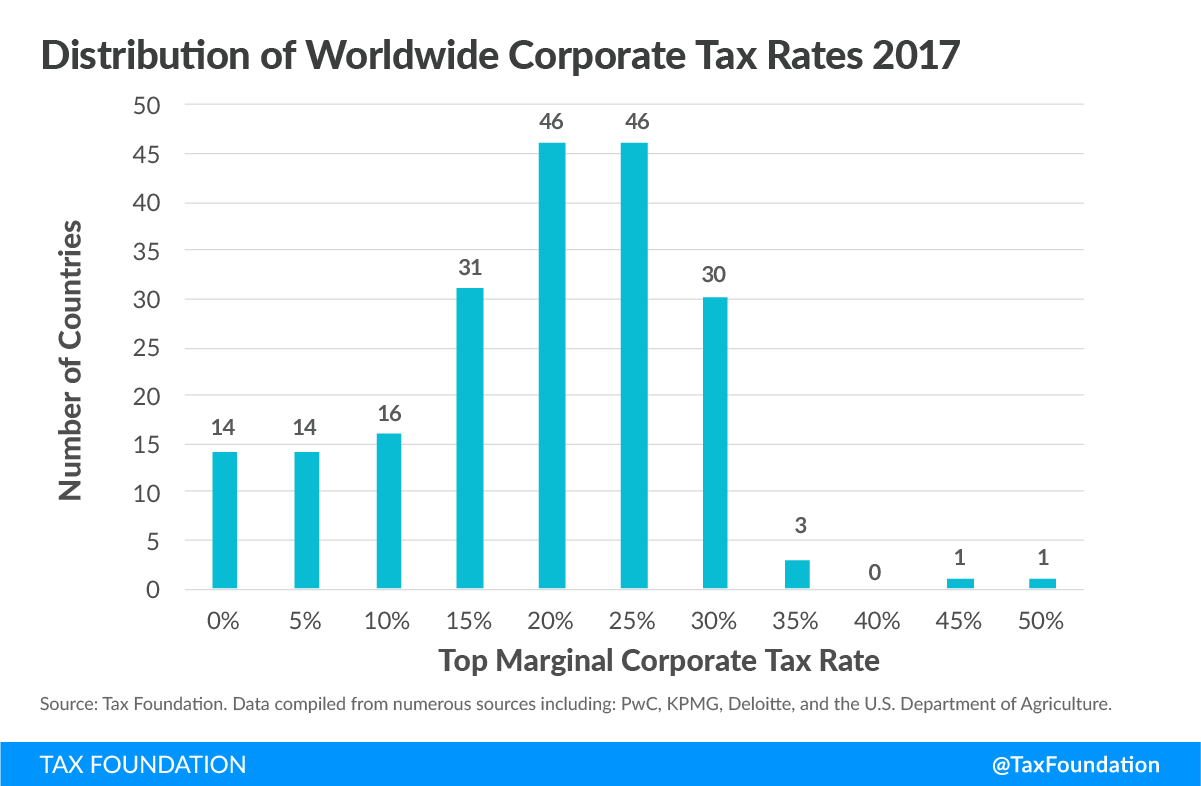

Corporate Tax Rates Around The World Tax Foundation

Economic Survey Of Japan 2008 Reforming The Tax System To Promote Fiscal Sustainability And Economic Growth Oecd

2 Toward Improvement Of The Business Environment Jetro Invest Japan Report 2016 Summary Reports Why Invest Investing In Japan Japan External Trade Organization Jetro

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

5 General Business Tax Issues Treasury Gov Au

World S Highest Effective Personal Tax Rates

Japan Taxation Of Cross Border M A Kpmg Global

Interest Rate And Tax Rate Information For Pension Arbitrage Download Table